Purpose of restaurant payroll programs

Payroll is a complex process. Even more so for restaurants since employees receive multiple types of compensation such as salaries, hourly wages, and tips, which all fall under different regulations. When you add in navigating tip credits, schedules, and overtime, paid family or sick leave, payroll taxes, and more, it can get pretty intimidating.

When you multiply those factors with the responsibility of staying compliant with regulations that vary between federal, state, and local levels things get even more complicated. A restaurant payroll program can help operators navigate the payroll process, provide employees a seamless experience, and free up the accounting and HR teams.

Download the free guide: Ultimate Guide to Payroll for Restaurant Operators.

What to look for in a restaurant payroll program

There are many technology solutions available to assist with payroll, including restaurant-specific payroll systems designed to help you meet your payroll obligations, avoid any non-compliance penalties, and ensure accurate recordkeeping. It can be difficult to choose which payroll system fits your business, but whatever your system looks like, below are certain payroll challenges it should address.

What to expect from a restaurant payroll program

Improved bottom line

A restaurant pays around 30% of their revenue towards employee payroll. Between the high overhead costs and the high turnaround, people management significantly and undeniably has an impact on a restaurant’s ROI. Restaurant payroll software allows managers to improve the bottom line by cutting overhead expenses through removing some of the manual work and empowering team members.

Increased data integrity

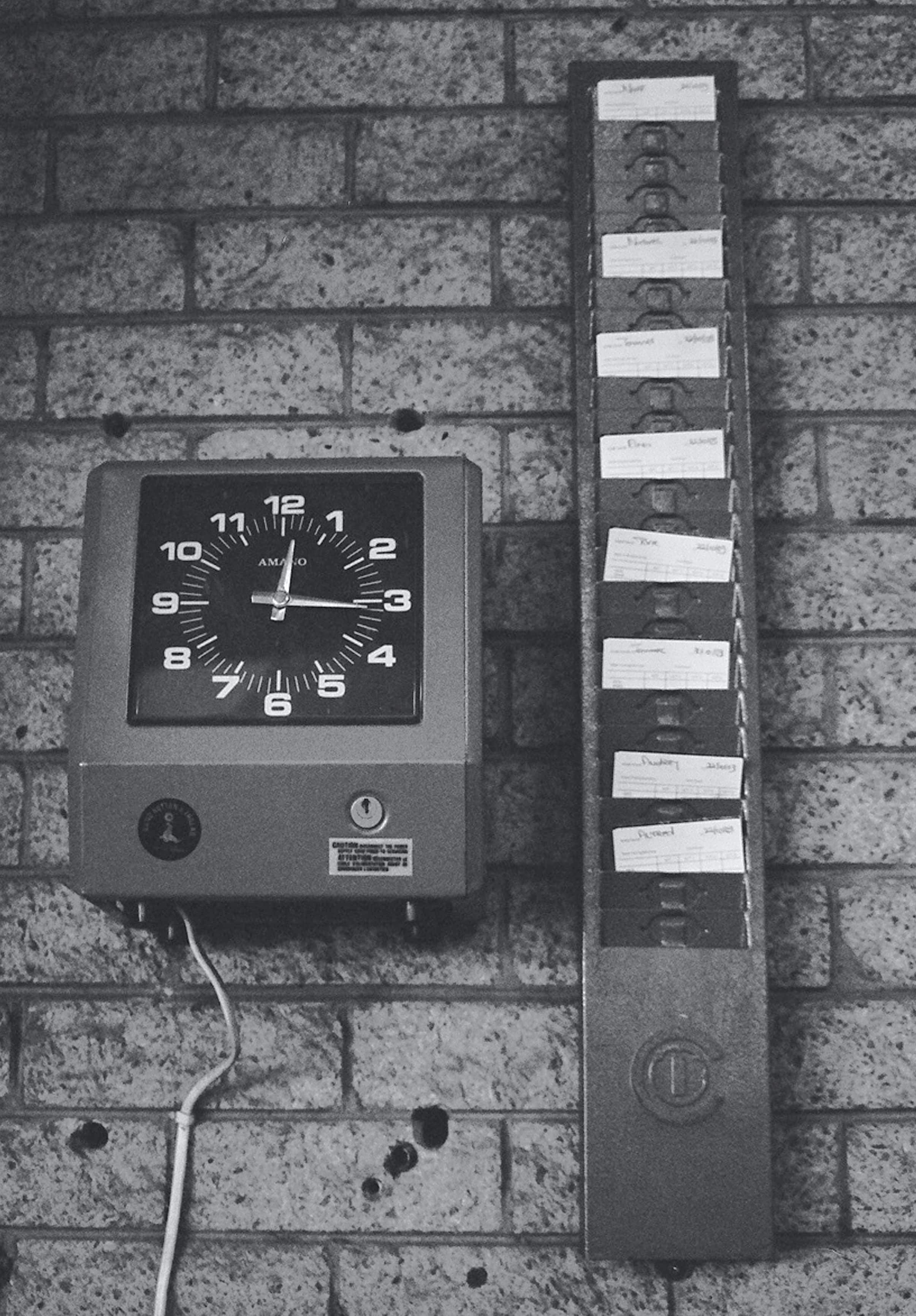

Many restaurants use separate systems for time tracking, scheduling, and payroll. When it comes to processing and reporting on payroll, a restaurant needs data from all these different systems. Manually transferring data by hand is inefficient, costly, and error prone. Payroll solutions that integrate directly with your accounting solution, POS, and scheduling system can easily transfer information risk-free.

Enhanced visibility and communication

Automated time tracking can benefit both the company and the employee. When scheduling and payroll data is visible to employees, they can view their schedules and request extra shifts or time off. In addition, employers can view employee habits and trends, allowing data analysis that can better inform labor spend in the future.

Time savings

HR, management, and accounting teams spend too much time inputting redundant information across multiple channels. Having an integrated solution removes some of these manual touch points, giving back time to the applicable team members.

Mobility

It should offer mobile paystubs that can be easily accessed via a mobile app. It should also offer payment via popular consumer apps like Venmo, PayPal, and CashApp, or a payment card for the unbanked, who number in the millions. With an integrated, automated payroll system, operators can also offer employees the unique ability to receive their pay daily if they wish, a significant to help attract and retain team members during a lingering labor crunch.

Tip tracking

Because you are responsible for reporting your company’s income and wages to the IRS, your payroll solution should be the backbone of your recordkeeping and reporting responsibilities. By implementing employees’ tip reports daily, weekly, or per payroll period, and using your payroll solution to track the different sources of tips, you are better equipped to meet the myriad of payroll tax obligations that come with tipped employees.

Assistance with federal, state, and local payroll tax laws

Pay rates and tax laws that change from state to state and even city to city making compliance complicated, especially important if your restaurant group has locations in multiple states. A good payroll system should help you maintain compliance with all federal, state, and local payroll tax laws.

Record maintenance

The general guideline in the payroll industry is that most businesses should maintain payroll records for three years. However, some businesses that are experiencing special circumstances, like a missed return, fraudulent return, or misreported income, may need to maintain records up to six years.

Whatever your timeline, it’s important to have a payroll accounting database, like a web-based software solution, that doesn’t purge employee data. With restaurant payroll software, you can have access to a full audit trail with information stored in a secure database.

Increased applicant interest

Payment flexibility speaks to the present-day workforce and differentiates employers by offering the ability to pay employees daily. To stand out as an employer, your restaurant may want to consider processing payroll more often than every two weeks. Modern payroll solutions allow employees to decide when they would like to be paid (bi-weekly, weekly, or daily) and how they want to be paid (via pay card, direct deposit, or physical check).

Employee retention

Restaurants have a high turnover of 75-150% every year. New hires cost time and money to onboard and get up to speed. Therefore, it is imperative for restaurants to be strategic about employee overhead and do their best to maintain talent to improve the bottom line. Automated and integrated payroll gives reassurance and builds the employee’s trust and brand advocacy. It also provides visibility and empowerment to the leaders, HR teams, and accountants toward optimizing their people strategy.

Conclusion

Restaurant payroll can be complex, but with an understanding of the basic concepts, you are better equipped to meet any new challenges. Once you set up thorough, functioning payroll and HR systems you can spend more time focusing on what you need to: running your business. If you’d like to know more about solving the challenges of restaurant payroll, download the free guide, Ultimate Guide to Payroll for Restaurant Operators.

Restaurant365 incorporates Payroll + HR software, scheduling software, accounting software, restaurant inventory management software, and restaurant operations software into an all-in-one, cloud-based platform that’s fully integrated with your Point-of-Sale system, as well as to your food and beverage vendors, and bank.