Restaurant Accounting to Drive Growth

R365 Accounting is the engine of growing restaurant groups, helping improve margins and scale without adding overhead thanks to frictionless POS integration, a direct general ledger connection, automated accounts payable, and real-time reporting.

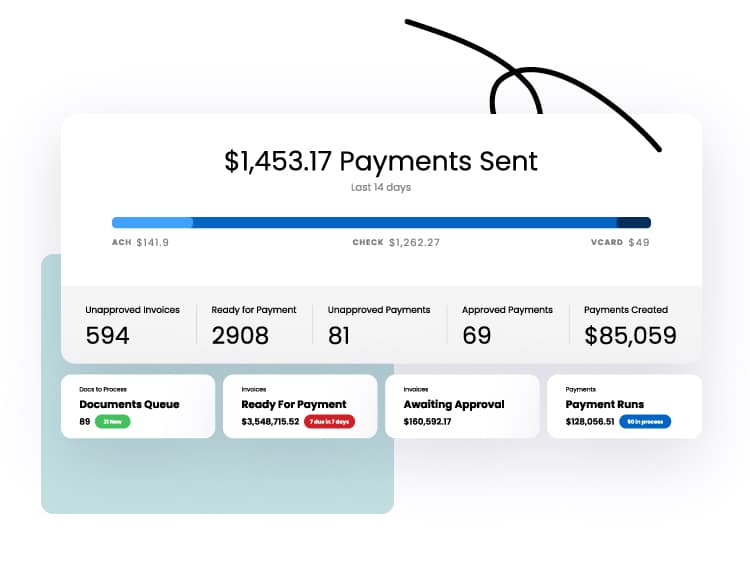

AP Automation

Automate Accounts Payable

Modernize your entire accounts payable process from invoice capture to approval workflows with cost-effective payment options.

- Say goodbye to stacks of invoices.

- Set up approval workflows.

- Eliminate manual check writing.

- Earn rebates on your payments.

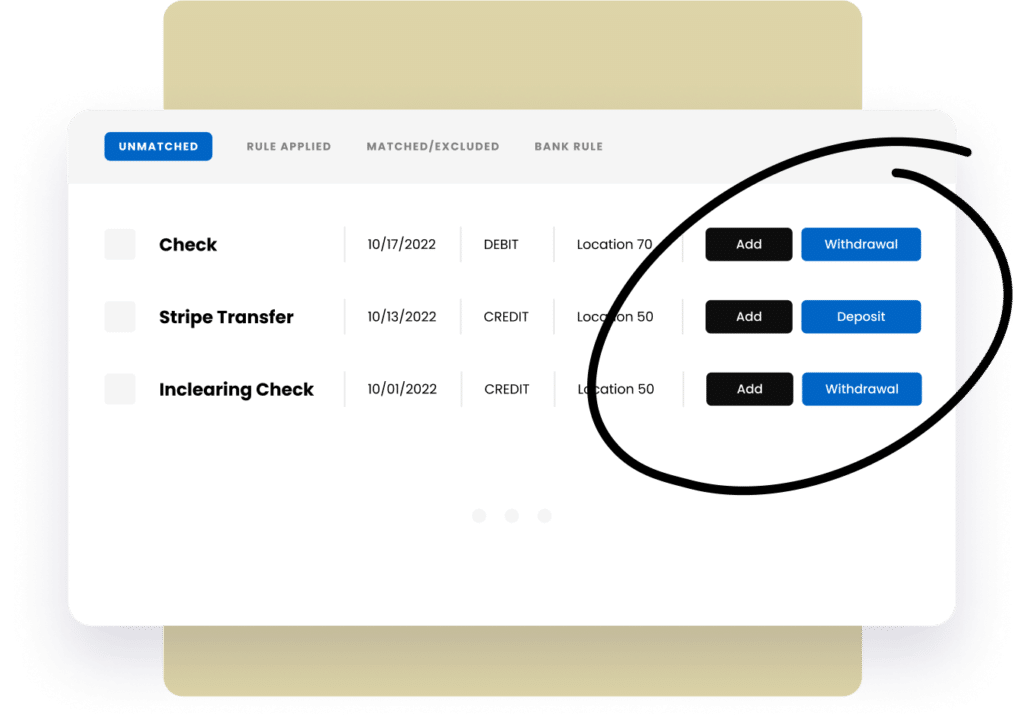

Modern Banking

Securely Connect to Your Bank

Direct integration with your bank lets you see and manage all financial transactions in real-time with a single click.

- Track deposits in near real-time.

- Reduce the time required to reconcile your books.

- Eliminate payment errors and fraud.

- Securely process and record vendor payments.

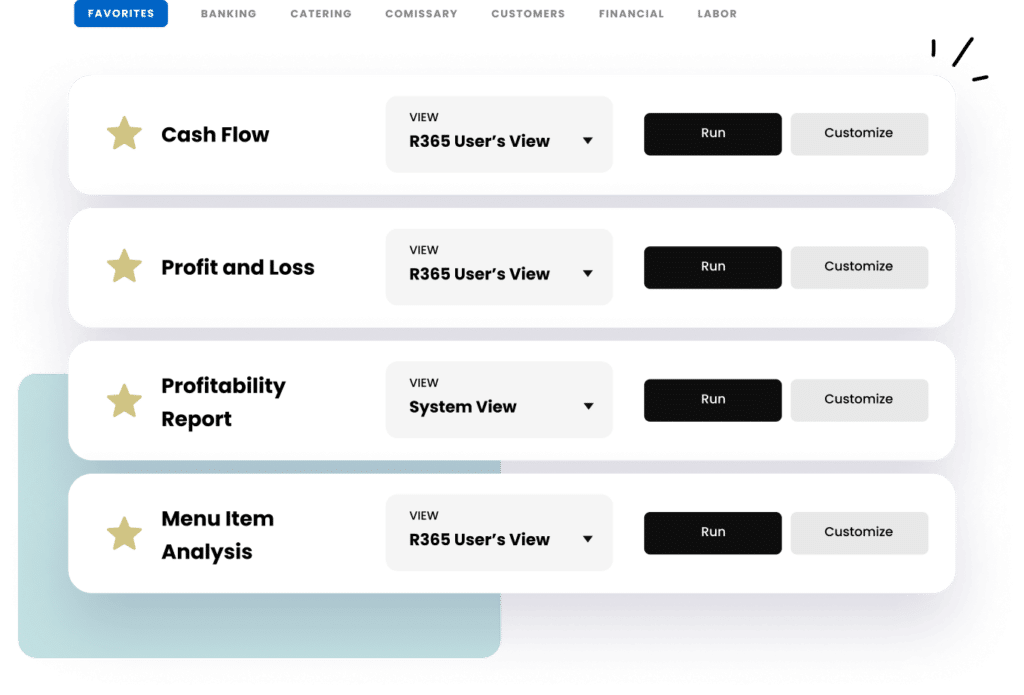

Financial Reporting

Take Your Financial Pulse

Visualize your restaurant group’s financial health with out-of-the-box or custom reports at the frequency and detail you need to make data-driven decisions.

- Easily integrate your POS for maximum accuracy.

- Personalize your financials.

- Analyze sales and labor data in real-time.

- Spot problems or opportunities as they arise.

Budgeting and Forecasting

Budget and Forecast Smarter

Drive your restaurant group toward its full potential with the ability to budget for multiple locations simultaneously.

- Set data-driven labor and inventory expectations.

- Create goals and monitor progress.

- Forecast by revenue center.

Accounts Payable Process

What is the account payable process? The accounts payable process is a crucial part of running a business. But what is accounts payable, and why does it matter? Accounts payable refers to the money companies owe to other businesses, such as their vendors. By staying on top of your accounts payables you can avoid missing payment deadlines and remain in good standing with your creditors. Many restaurant businesses, especially large brands that deal with a lot of food and beverage vendors, have teams or departments specifically dedicated to managing the accounts payable process.

While accounts payable tasks differ from business to business, following best practices in accounts payable process can help ensure you stay organized and avoid missing any important items. The typical accounts payable process involves coding or sorting invoices, getting them approved, and posting them for payment. Automating your accounts payable process can save you a lot of time. For instance, if there is a certain aspect of accounts payable that takes forever to complete, you can choose to automate that task so that your teams are freed up to focus on other things.

Restaurants especially can benefit from having some type of accounts payable management system, whether that involves automation, manual processing, or a combination of both. Restaurant365 is an all-in-one platform that enables users to manage their restaurant operations. It offers products for accounting, inventory, payroll, and more. With Restaurant365, you can get a comprehensive look into your accounts payable process and work to simplify your AP-related tasks as much as possible.

Accounts Payable Cycle

Generally speaking, the accounts payable cycle follows a standard process and is sometimes called procure to pay, or P2P. Companies begin by determining the number of items they need, procuring those items, and looking for suppliers. Then, they work to negotiate and purchase those items. Once the items are delivered, they receive an invoice and pay that invoice, and the cycle repeats. Some businesses have accounts payable sub-processes, but for the most part, it follows a fairly unchanging pattern. Most businesses choose to streamline at least part of their accounts payable process, as this can help ensure continuity and efficiency.

For more information on how accounts payable works or to get some accounts payable ideas for your own business, you might look to your partners or even competitors to see what’s working well for them. Your AP cycle can be customized to fit your unique needs, but it can be helpful to see what others are doing to fully optimize their process. Staying on top of your accounts payable tasks is of the utmost importance, but it can be difficult trying to juggle everything at once. You might consider offloading certain tasks to other teams or departments, depending on what they’ve already got on their plate. There isn’t necessarily a right or a wrong way to manage your AP cycle as long as you’re hitting your targets and getting everything done on time.

Accounts Payable Process Steps

The end-to-end process of accounts payable is fairly standard. Accounts payable process steps typically involve receiving your invoice, reviewing and approving that invoice, and finally paying your vendors. You can find lots of tips and guidance on how to manage accounts payable effectively, and there isn’t really a one-size-fits-all solution to optimizing your AP process. Still, by following a few basic steps, you can increase your efficiency. The typical step-by-step accounts payable process is a great way to manage your invoices and ensure you get your vendors in a timely manner.

With Restaurant365, you can manage your accounting process, including AP, more effectively. The software combines all of your critical accounting items into a central platform, allowing you to access what you need in a single location. It can easily integrate with your POS system, bank, and more. Restaurant365 makes it easy for users to view and approve their invoices and quickly resolve any issues related to their accounts payable process.

Accounts Payable Automation

Accounts payable automation has many benefits. First and foremost, you can automate time-consuming, manual tasks that would otherwise cost your business valuable time and money. In many cases, accounts payable automation best practices involve at least some degree of automation, as you can get a lot more done in a shorter amount of time by automating your process rather than doing everything by hand. This can increase efficiency across the board. It can also be helpful to make an accounts payable internal control checklist to determine which steps in the process may be most compatible with automation.

The automation of accounts payable can be accomplished a number of ways. Restaurant365 offers a full-service automation solution to help users automate their accounts payable process, eliminating many of the manual tasks associated with AP management. You can take advantage of rebates through virtual card payments, foregoing the time-consuming process of printing and sending paper checks. Payments made through Restaurant365’s software are always secure, as the platform is SOC certified and designed to help protect you from fraud. Automating your accounts payable with Restaurant365 can be a great way to organize and streamline your restaurant’s accounts payable process for maximum efficiency.

Accounts Payable Cycle Formula

An accounts payable cycle formula can help you better understand your AP process. For example, the accounts payable turnover ratio is used to determine how quickly a business is able to pay its vendors. Managing the AP cycle is complex, which is why many businesses appoint an accounts payable team or manager to focus specifically on accounts payable. If you’re looking to hire someone for this role, you might consider asking some accounts payable process interview questions to get a feel for their management style.

On a similar token, if you’re considering hiring someone to conduct a deep dive into your AP process and provide you with detailed information on how to improve, you might ask accounts payable analyst interview questions. In short, there are many different accounts payable job interview questions and answers you could ask a prospective AP hire, and it’s important to determine how you want to manage your accounts payable process and cycle to ensure the best results. Managing accounts payable isn’t always easy, but with a dedicated AP team on hand, you can be better equipped to tackle any AP-related challenge that comes your way.

Accounts Payable Training Manual

When onboarding new AP team members, it can be helpful to have an accounts payable training manual to help keep everyone on the same page and ensure that best practices are being followed. You might even want to design some sort of quiz with accounts payable test questions and answers. This can be a great way to assess your team’s knowledge of the AP process; it can also suggest areas for improvement. Having a training manual can help standardize your process and improve accuracy all around. You don’t want to have one person doing things one way and another person doing something totally different. This can lead to all sorts of problems.

Your accounts payable procedures manual might also address the steps to take if something goes wrong—say, for instance, you misdirect a bill or lose track of an invoice. It’s important to be proactive, not simply reactive, when it comes to your accounts payable process, so you might consider training teams on how to prevent issues from arising in the first place. Regularly updating your manual can help you stay on top of things and keep your teams informed on how to keep the process flowing smoothly.

Ways to Improve Accounts Payable Process

There are many ways to improve accounts payable processing tasks. You can start by implementing automation or automating at least some of the processes. For instance, you might eliminate paper invoices and switch to digital. Additionally, you could set up reminders for payments so that you never miss a deadline. Your accounts payable procedures can be simplified by following a few key steps, namely sorting and organizing your invoices and determining which tasks to automate and which to continue doing by hand. As always, it’s important to follow accounts payable best practices.

One of the especially convenient features of Restaurant365’s AP automation solution is AP capture. This allows users to capture invoices using different methods and can be a great way to improve your accounts payable process. You can upload the invoice directly into Restaurant365, send an image through a mobile device or scanner, or allow vendors to send invoices directly into R365. What’s more, you can automatically create detailed accounting records and set up approval workflows so that your invoices are processed as quickly as possible.

Restaurant365 even allows users to implement multi-level approval workflows based on dollar amount, location, and other criteria. AP automation software can transform the way you manage your accounts payable process, freeing you from the time constraints of managing everything by hand. Restaurant businesses can benefit from this software and become better equipped to train teams on how to properly handle AP-related tasks.

Accounting and Payroll Software | Accounts Payable Process | Best Inventory Management Software | Best Restaurant Management Software | Food Inventory Management | Inventory Management | Inventory Management Software | Inventory Tracking Software | Kitchen Operations | Kitchen Operations Checklist | Online Restaurant Management System | Restaurant Management | Restaurant Management System | Restaurant Software Systems | Restaurant Staffing | Restaurant Staffing App | Restaurant Staffing Guide | Workforce Payroll

R365 Customers Succeed with Restaurant-Specific Accounting

Spend Less Time Crunching Numbers and More Time Growing

R365 Accounting

Looking Solely for Restaurant Accounting Software?

Learn how R365’s industry-specific accounting software is perfectly tailored to help your restaurant group's Accounting team drive the business forward.

See How You Can Save Money with R365

Request a Demo of

R365 Accounting

Learn how R365 Accounting can help you keep tabs on your restaurant group's financial health and meet your profitability goals.